Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

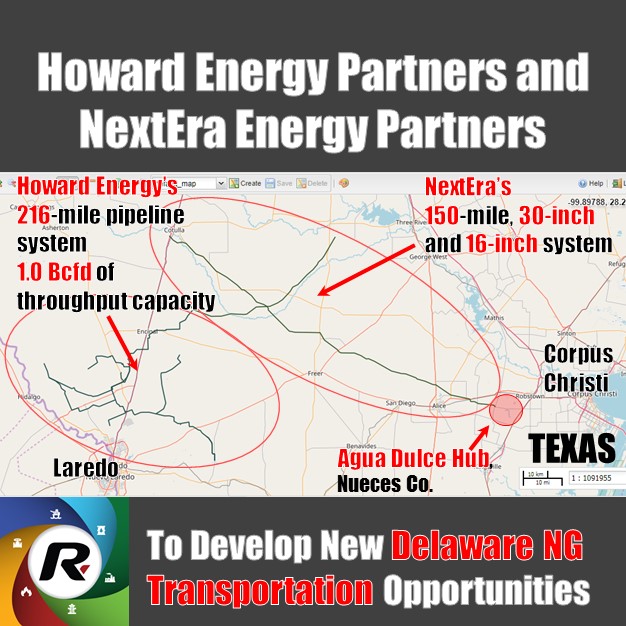

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.

The Worst is Over: Gulf of Mexico Oil and Gas Production Nearly Restored After Hurricane Francine

The Gulf of Mexico’s oil and gas production is bouncing back quickly following the disruption caused by Hurricane Francine. According to a statement from the Bureau of Safety and Environmental Enforcement (BSEE) on Monday, nearly all of the region's energy output has been restored, signaling a significant recovery after the storm passed. As of Monday morning, about 12.18% of oil production and 16.02% of natural gas production in the Gulf remained shut down, according to operator reports. This marks a vast improvement from the peak of the storm’s impact when more than half of the region’s natural gas output and over 40% of its oil production were offline.

Massive Shutdown in U.S. Gulf of Mexico as Tropical Storm Francine Approaches

A significant portion of the U.S. Gulf of Mexico's oil and natural gas production has come to a halt as Tropical Storm Francine barrels toward Louisiana, threatening the region's crucial energy infrastructure. In what is shaping up to be one of the most impactful events for U.S. energy this year, approximately 24% of crude oil production and 26% of natural gas output in the Gulf are now offline, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE). Francine, with winds reaching 65 mph (100 kph), is currently situated 380 miles (610 km) southwest of Morgan City, Louisiana, and is expected to strengthen into a hurricane by the end of the day. The storm's trajectory is causing widespread disruptions to offshore operations in the Gulf, which plays a vital role in the country’s energy supply.

Gulf of Mexico: TotalEnergies Extracts First Oil from Anchor Field

TotalEnergies has announced the start of oil production from the Anchor field, located 225 km off the coast of Louisiana in the Gulf of Mexico. The Anchor field began development in December 2019 and is a joint project between TotalEnergies, which holds a 37.14% stake, and Chevron, the operator, which has the remaining 62.86%.

Kinder Morgan Overview: 2022 vs 2023, Oil & Gas Wells, Pipelines, Terminals, Deals

Kinder Morgan stands as North America's top independent mover of petroleum products with around 2.4 million barrels daily across the continent. The bulk of this flow happens through its Products Pipelines division, which navigates gasoline, jet fuel, diesel, crude oil, and condensate through a network of about 9,500 miles of pipelines. Alongside, the company maintains roughly 65 liquid terminals that not only store these fuels but also blend in ethanol and biofuels for a green touch.

U.S. Oil and Gas Drilling 2023-2024 Report: Rigs, Onshore, Offshore Activity, Biggest Companies

In January 2024, the United States saw a mix of ups and downs in the number of active drilling rigs across its major oil shale regions and states. Starting with the shale regions, the Permian Basin led with a slight increase, reaching 310 rigs, which is 3 more than in December. The Eagle Ford in East Texas held steady with 54 rigs, unchanged from the previous month. Meanwhile, both the Haynesville and Anadarko regions saw a decrease by 2 rigs each, landing at 42 rigs. The Niobrara faced a larger drop, losing 4 rigs to settle at 27. On a brighter note, the Williston Basin and the Appalachian region saw increases of 2 and 1 rigs, respectively, resulting in counts of 34 and 41 rigs.

Hess Corp. Increases Drilling Activity Before Chevron Takeover

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

Talos Energy Confirms $1.29 Billion Takeover of QuarterNorth Energy

Houston-based Talos Energy Inc. has made a deal to buy QuarterNorth Energy Inc. for $1.29 billion. QuarterNorth is a company that explores and produces oil in the Gulf of Mexico and owns parts of several big offshore fields. This purchase will add more high-quality deepwater assets to Talos's business, which are expected to bring steady production and new opportunities for growth. The deal should immediately benefit Talos's shareholders and help the company reduce its debt faster.

Talos Energy and Repsol Join Forces in Gulf Exploration JV

alos Energy and Repsol have formed a partnership, each owning 50-50, to reexamine seismic data in a shared area to identify where to drill in the coming years. Tim Duncan, the CEO of Talos, sees this as a strategic use of land they acquired from EnVen Energy Corp to enhance its value. Talos Energy is putting to use the land they bought from EnVen Energy Corp for $1.1 billion. CEO Tim Duncan talked about this on November 7, explaining that it's a smart move because the government has delayed a big decision on new ocean drilling areas. By teaming up with Repsol, Talos plans to work on the land they already have, about 100,000 acres, so they don't have to wait for new permits.

Arena Energy Makes a Deal with Cox in GoM, Adding ca. 1,000 net boe/d to Arena's Total Production

On January 24 Independent E&P Arena Energy LLC acquired Cox Operating LLC's interests in the Eugene Island 330 and South Marsh 128 oil blocks. Cox Operating, based in Dallas, Texas, includes interests to Arena's existing ownership interest in the Gulf of Mexico fields, which it purchased from GOM Shelf LLC.

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

.jpg)

- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)

Gulf Mexico Oil and Gas Map_ 2023 Review.png)